Quarterly Wrap-Up: Q2 2023 Report Now Available!

- Brandon Miller

- Jul 13, 2023

- 4 min read

Across the automotive industry, the end of Q2 often offers a chance for OEMs, suppliers, and start-ups to reflect on their achievements so far while preparing to execute their plans for the second half of the year and beyond.

In the second quarter of 2023 alone, dozens of new innovations have already set the foundation for the future of automotive – with movements in new areas such as AI and the software-defined vehicle (SDV), and the advancement of more traditional technologies, including vehicle autonomy and connectivity. However, the volume of these movements and the pace at which they are announced make it difficult not only to keep track of this activity, but to truly identify, assess, and recognize its impact on the industry moving forward. Through a clear, grounded, and hype-free view of the quarter’s most notable activities and announcements, our complimentary Quarterly Wrap-Up Report for Q2 2023 offers a tailored selection of trends accompanied by insightful commentary from our industry experts.

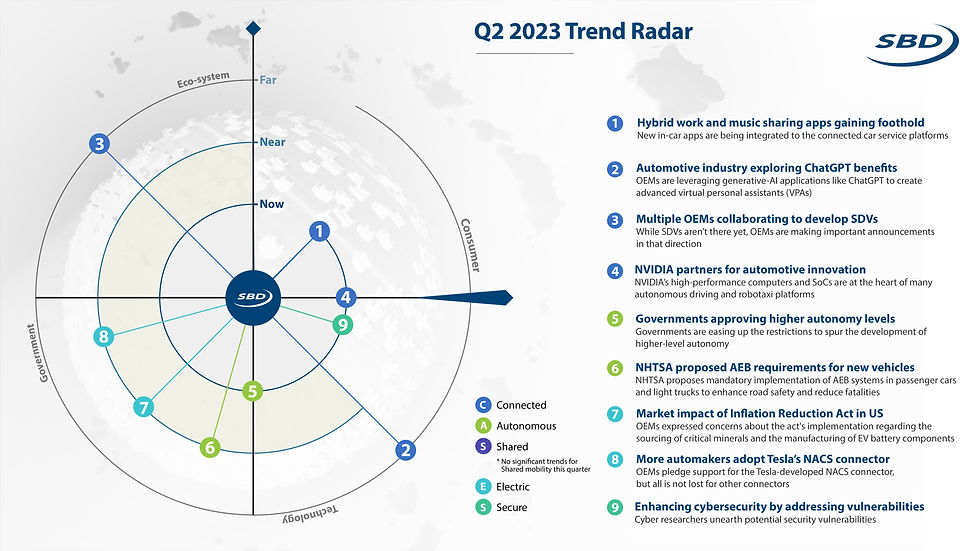

For Q2, our analysts begin by categorizing the quarter’s top trends and identifying how soon they will come to impact OEMs and their customers. Here, for example, one of the key technology trends highlighted by our experts is the industry’s exploration of AI through the application and benefits of ChatGPT – an AI chatbot developed by OpenAI – can inside the vehicle.

Following the impact it has already had on various industries beyond automotive, key industry players are now investigating how the chatbot’s language recognition and generative capabilities can enhance their virtual personal assistant (VPA) offerings. In targeting VPA integrations specifically, automakers will look to leverage ChatGPT’s large language model to enable more natural conversation opportunities. Mercedes-Benz has already announced plans to partner with Microsoft, a primary investor in OpenAI, to integrate ChatGPT into MBUX - its proprietary infotainment system. GM, likewise, has publicly expressed interest in adding the chatbot to its vehicles, though the corporation has yet to make an official announcement on the matter. The trend extends further across the industry through Turo, an American car sharing company which has developed its own third-party ChatGPT plug-in that supports and enhances consumer interactions around its core service offering. In addition to offering these insights, our experts take a deeper dive into how AI platforms, such as ChatGPT, can benefit the vehicle lifecycle more broadly, from the development and production stages to the design and implementation of in-vehicle services, as well as its various benefits for consumers.

Another trend from the past quarter highlighted by our experts, that will deliver a more immediate impact, is the approval of higher autonomy levels by governments in different regions. While this approval permits the operation of select systems operating at SAE Level 2 (L2) and Level 3 (L3), the systems themselves are still subject to specific rules and requirements. BMW, for example, received permission from German authorities to operate its L2 semi-autonomous driver assistance system, though only on divided autobahns and exclusively in the 5 Series and electric i5 at up to 130 km/h (around 80 mph). More broadly, Mercedes-Benz has received approval from authorities in California to operate Drive Pilot, its L3 conditionally automated driving technology. This marked the second U.S. state to approve the system, following Nevada in Q1. A similar movement can be seen further across the globe in China, where domestic OEM Xpeng obtained approval to launch its semi-autonomous driving technology in Beijing – the first Chinese automaker to do so. The quick succession of these approvals, especially in different parts of the world, ultimately illustrates a shift in the approach government officials and organizations have towards automated features and autonomous vehicles as a whole.

Digging deeper into the trend, the Quarterly Wrap-Up offers insight into the progress of autonomous vehicle deployment – accounting for this development in the regions impacted by the trend and globally. Here, and for the other Q2 trends highlighted by our experts, further insight is provided through an excerpt of an adjacent research report from our report catalog – in this case, a page from our L4 Autonomy Forecast that maps out the typical deployment of an autonomous driving system before breaking down how and where regulation is impacting this deployment in different regions.

Together, these trends ultimately represent significant milestones that will impact the industry both imminently and in its future, disrupting how automakers develop and produce their vehicles as well as the ways in which customers will interact with them. However, the examples detailed in this article are just two of several key trends highlighted and analyzed by our experts in the Quarterly Wrap-Up Report for Q2 2023.

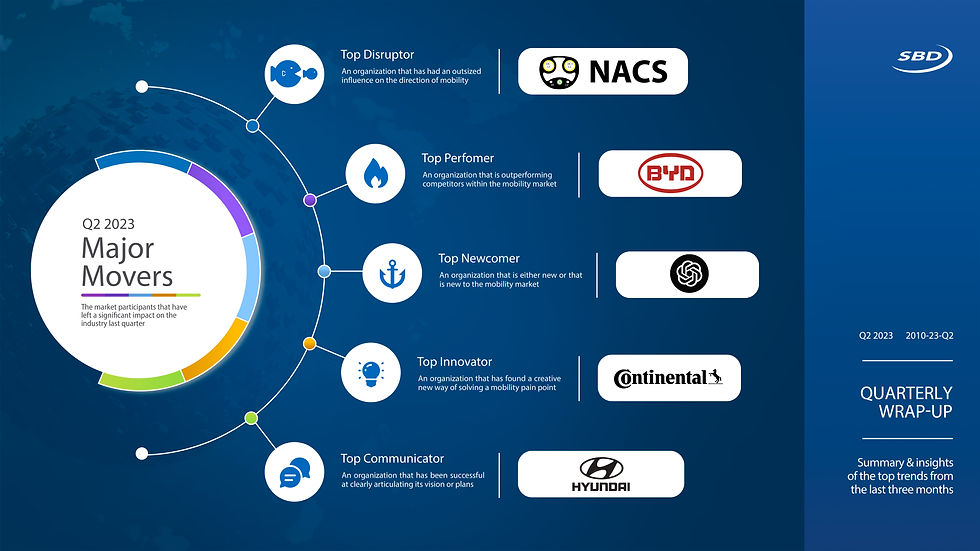

Provided as a free report for anyone to download and read, it takes a deep dive into the latest trends spanning the full range of CASES (Connected, Autonomous, Shared, Electric and Secure), highlights the players, companies, and organizations that have disrupted the automotive industry over the past quarter through truly impactful activities, and offers a full list of relevant news articles from the last three months categorized by each area of CASES.