OEMs risk falling behind stringent ICE bans

- Brandon Miller

- Sep 9, 2022

- 3 min read

Originally published on the SBD PORTAL in September 2022

As the world transitions toward an electrified and decarbonized future, regions around the world have taken approaches of varying stringencies to promote the production and sale of electric and zero emission vehicles. The European Union is perhaps the most aggressive regulator, having championed leading greenhouse gas / fuel economy standards and targets for economy-wide decarbonization in the past, and now pushing its more stringent “Fit for 55” proposal that could effectively ban internal combustion engines (ICE) in the bloc altogether.

In this insight we will explore the status and key provisions of the current “Fit for 55” proposal in the EU, its complimentary emissions regulations, the future of internal combustion engines in the region, and how this level of stringency translates into automakers’ ZEV planning.

What is happening?

The EU is combating emissions with a focus on transportation – positioning itself to have one of the most stringent ZEV mandates of all major trading blocs.

“Fit for 55” is on an expedited legislative schedule, but more negotiations remain before the package can become law. Euro 7 will compliment “Fit for 55” and support its targets for LDV and economy-wide reductions.

“Fit for 55” signals an effective ICE ban – including hybrids - that will shift the market towards ZEVs. Anticipated Euro 7 standards have also been called a “ban through the back door” on ICEs by the Verband Deutscher Maschinen- und Anlagenbau, a German industry group.

Why does it matter?

Light Duty Vehicle (LDV) emission standards proposed under “Fit for 55” and Euro 7 will have a dramatic impact on automakers’ production plans in Europe, with little lead time.

Cars (12%) and vans (2.5%) make up a total ~15% of the EU’s CO2 emissions.

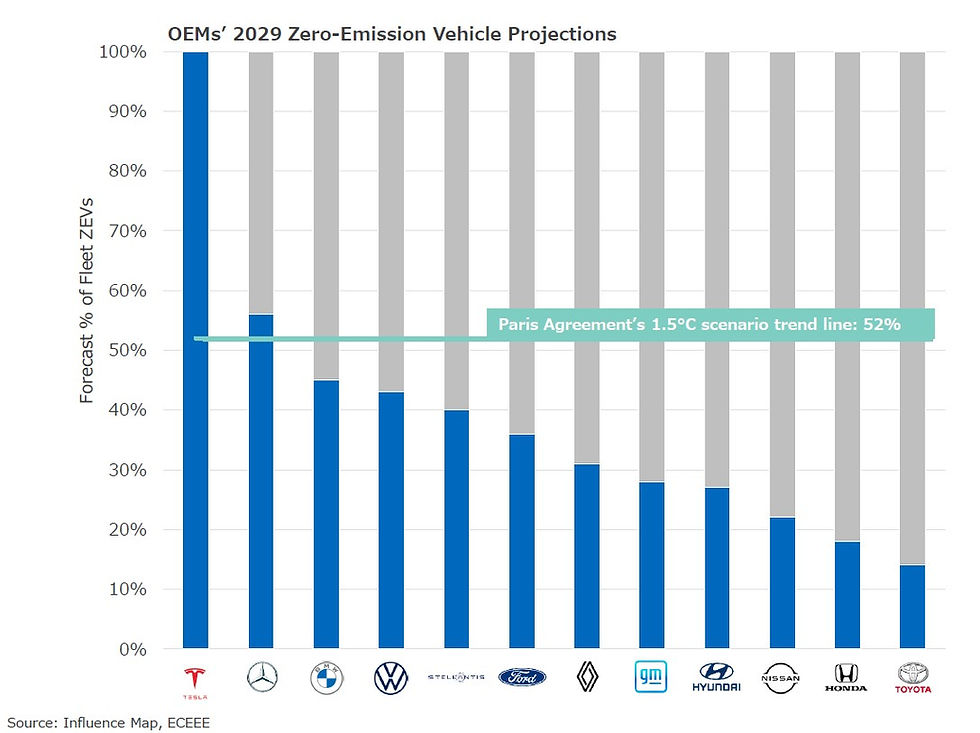

By 2029, 10 of the top 12 global OEMs will fall behind Paris ZEV targets.

OEMs may risk noncompliance if they do not rapidly accelerate planning / production to support a higher volume of ZEVs in the short- to midterm.

Tesla and Mercedes-Benz are the only OEMs currently forecasted to achieve interim ZEV mix/GHG reduction targets.

May be attributable to other automakers’ continued reliance on short-term (P)HEV and LEV sales.

Who to watch out for?

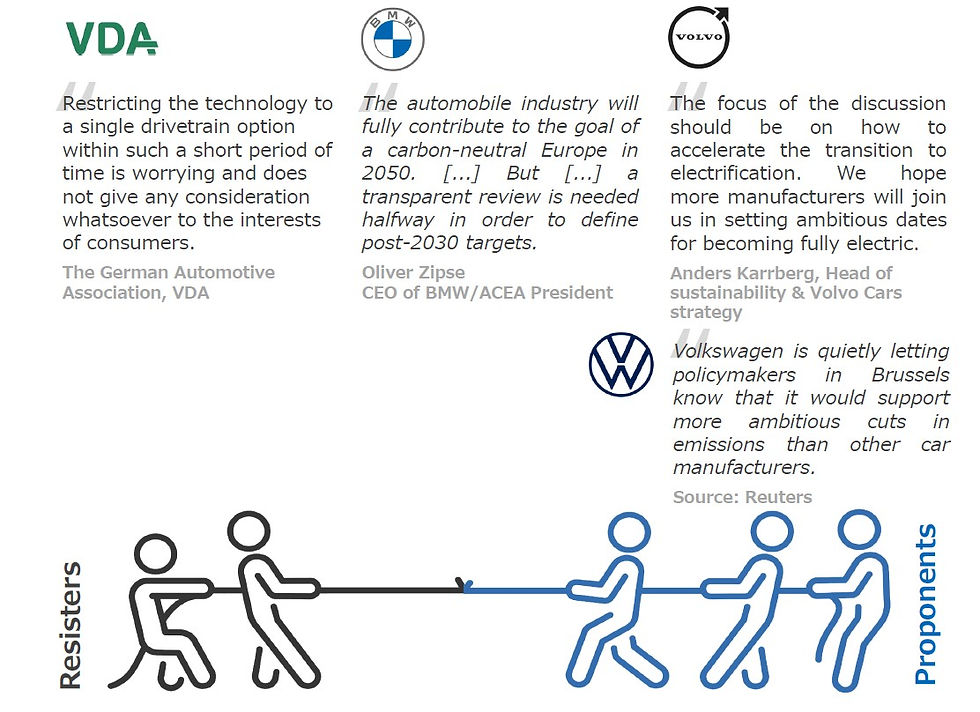

Generally, the industry is in support of “Fit for 55,” but not without concerns relating to investments, consumer adoption, and technology limitations.

VDA, the German Association of the Automotive Industry, is resisting “Fit for 55’s” ICE ban, despite German OEMs like Mercedes-Benz and BMW being well positioned for compliance.

VDA insists that a variable product mix is required to achieve timelines in a realistic manner as well as maintain consumer choice.

VW and Volvo have independently expressed their support, while BMW/ACEA are tentatively supporting the proposal. Many OEMs maintain that adjacent investments, such as in charging infrastructure and EV battery production, must aggressively progress to support the targets as proposed.

Among governments, there remain some, like Hungary, that have openly expressed their strong opposition to “Fit for 55”.

How should you react?

Jump off the fence

Automakers should plan for an imminent ramp up in emissions targets in the EU (with other global markets likely not far behind). Short-term product planning must account for the policy transition to ZEVs and move away from an interim reliance on PHEVs, LEVs, conventional hybrids, and ICEs.

Reorganize

Automakers may need to consider reorganizations to adapt quickly enough. Current business models may not support an efficient and accelerated transition to ZEVs. Restructuring and/or developing an EV-dedicated brand could capture new investor and consumer interest in competition with EV startups such as Tesla and Rivian, however this would require significant upfront investment.

Collaborate

Automakers should collaborate with all stakeholders - consumers, utility providers, and governments - to promote an environment that encourages and incentivizes ZEV adoption. OEMs should work with governments and utilities to accelerate the build out of charging infrastructure and renewable energy, and to offer desirable, equitable inventive programs for both ZEV purchases and charging. OEMs should also invest in consumer outreach and education to combat stigmas surrounding issues such as range anxiety or battery safety.

Interested in finding out more?

Most of our work is helping clients go deeper into new challenges and opportunities through custom projects. If you would like to discuss recent projects we've completed relating to emissions, ZEVs, and ICE Bans, contact us today!

Also, be sure to view our related content: